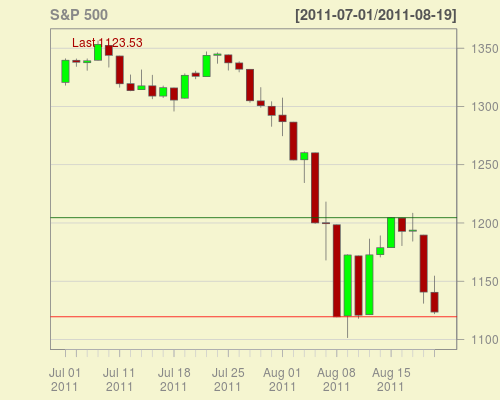

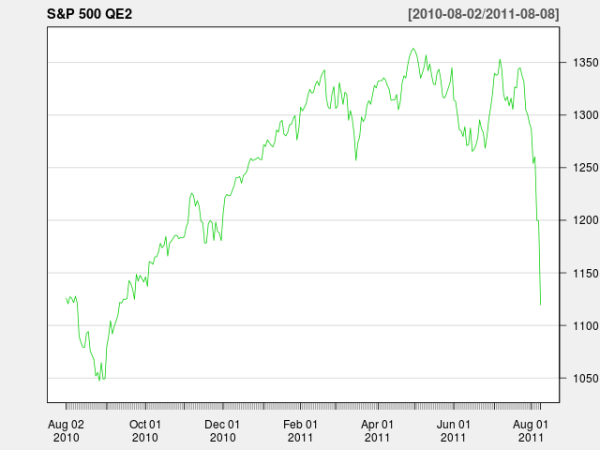

Looks like the markets finished a formation today, which could be interpreted as a buy signal, at least according to my interpretation of Schannep’s Dow Theory for the 21st century. As I mentioned in an earlier post both the S&P 500 and the Dow Jones Industrial were getting closer to the important levels. The big upswing today finished the formation for both indexes.

The chart for the Dow Jones Industrial is more or less the same:

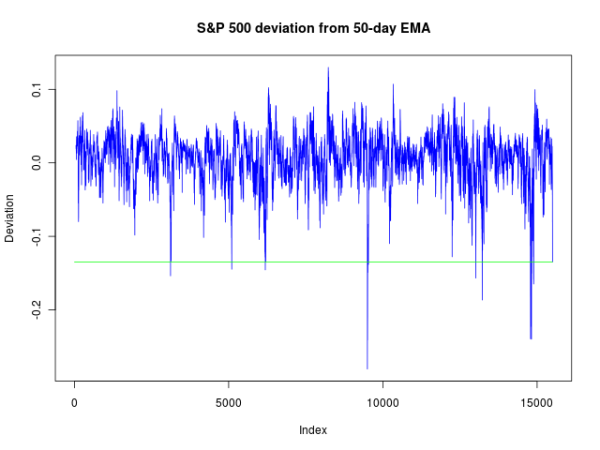

The red line shows the level where the sell signal was generated, while the new green line shows where the buy is signaled. Not a significant difference, the entry is about 1% lower than the exit. For the full description of this trading indicator, refer to the newsletter on the above mentioned web site (there is also a book there). In practice, the entry would have been a lower, since the author has an elaborate system to enter in steps, trying to fore-run the classical Dow Theory, and this step-wise process would have worked nicely here.

This is all assuming that the whole thing doesn’t turn sharply down and we indeed have reached an important bottom. Notice that there is no buy signal using the classical Dow Theory, which, by the way, doesn’t really have a quantitative description and is often interpreted differently by different acolytes, since the Dow Jones Transports haven’t confirmed the signal.

Is it going to be another triumph for the new Dow Theory? Wait and see …